About the RFQ System

This guide is for integrators/projects who would like to access 0x RFQ liquidity, via the Swap API. If you represent a trading firm or professional market maker that would like to supply RFQ liquidity, please get in touch here: 0x RFQ Interest Form

About the RFQ System

RFQ liquidity is currently available on Mainnet, Polygon, and Arbitrum via Swap API.

An Exclusive Source of Liquidity

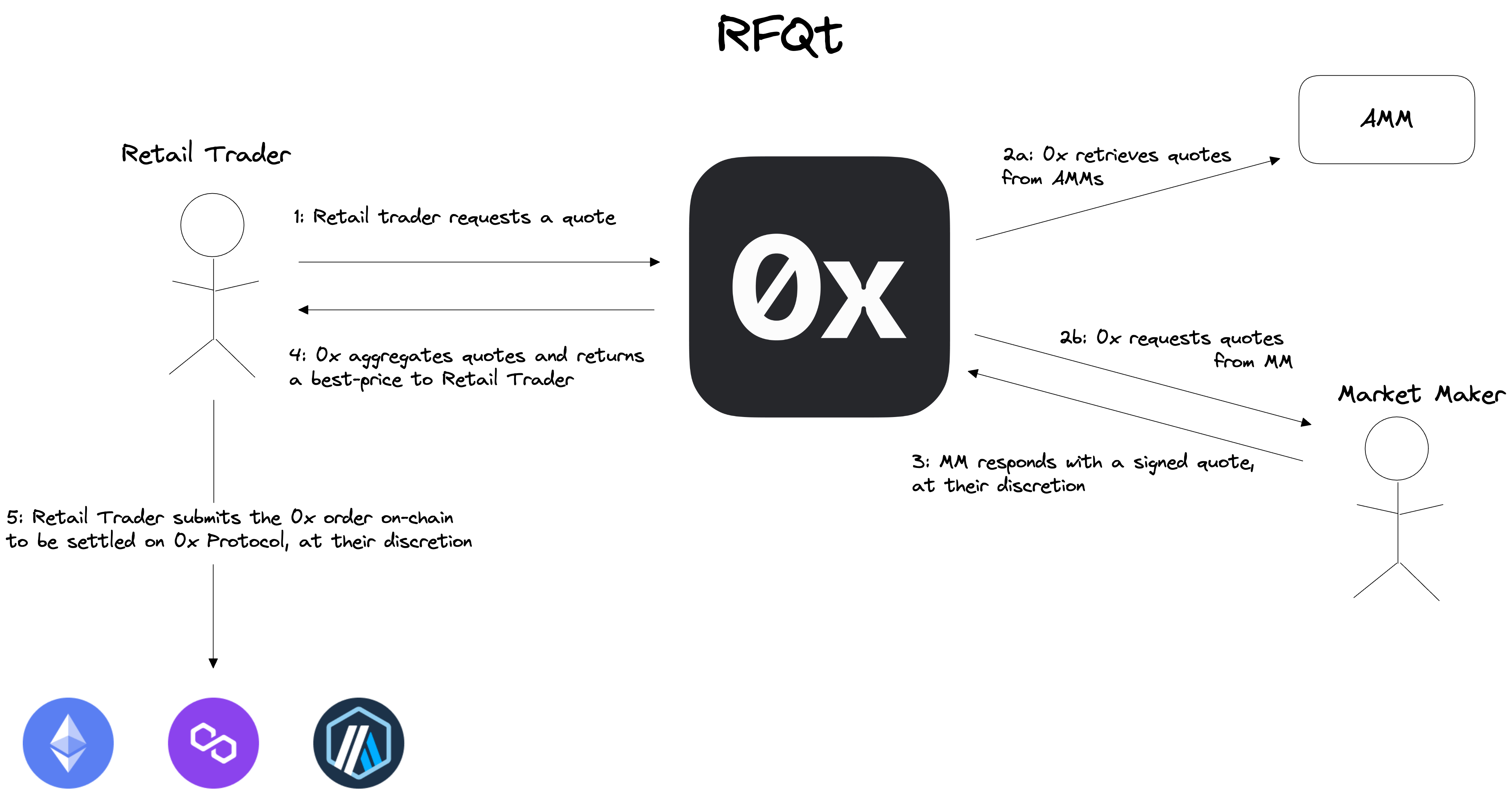

In its role as a liquidity aggregator, 0x's APIs integrates both on- and off-chain liquidity. On-chain liquidity is sourced by sampling smart contract liquidity pools, such as Uniswap and Curve. Off-chain liquidity is sourced from professional market makers via the 0x Request-for-Quote (“RFQ”) System.

The RFQ system allows traders to request real time quotes from market makers. This source of liquidity is exclusive to 0x, has 0 slippage, and better trade execution.

If integrators request a standard quote from the Swap API, part or all of their quote may be sourced via the RFQ system. In this system, the Swap API aggregates quotes from professional market makers, alongside quotes from AMMs. If the market maker quotes are more competitive than AMM quotes, they may be included in the aggregated final price shown to the end-user. The end-user’s liquidity is ultimately provided by a combination of AMMs and professional market makers. Everything happens under-the-hood!

Parties in the System

Takers

Takers fill 0x orders by agreeing to trade their asset for the Maker's asset; in other words, consume the 0x liquidity. When making a Swap API request, the RFQ orders must contain the takerAddress request parameter. When an order containing this parameter gets hashed and signed by two counterparties, it is exclusive to those two counterparties. This means that the order can only be filled by the taker address specified in the order. This is a security feature that prevents front-running and other types of attacks.

Market Makers

As mentioned earlier, 0x API works with specific market makers who participate in the RFQ system. Each maker is identified by an HTTP endpoint URL, and each endpoint has an associated list of asset pairs for which that endpoint will provide quotes. For the instance at api.0x.org, the 0x team is maintaining a list of trusted market makers.

Integrating RFQ Liquidity

Read about how to easily integrate RFQ liquidity into your project.

Learn More

Video

Check out this 0x DevTalks video where we explore:

- What RFQ liquidity is

- Which use cases benefit most from RFQ

- How to unlock optimal trades with RFQ liquidity in 3 simple steps