🤔 FAQ & Troubleshooting

Categories

Troubleshooting

I received an API issue / error code. Help!

See Handling API issues and error codes for a full list of common 0x issue types and error codes and how to resolve them.

Why am I getting a CORS error when using the 0x API?

TL;DR CORS errors happen because the 0x API enforces strict security policies. Avoid making API calls directly from the browser to prevent CORS issues and exposing your API keys. Instead, use a backend server, serverless functions, or a full-stack framework.

Error Message You might see an error like this:

http://localhost:3000 has been blocked by CORS policy: Request header field 0x-version is not allowed by Access-Control-Allow-Headers in preflight response.

Explanation

This error occurs because browsers block requests with custom headers (e.g., 0x-version) unless explicitly allowed by the server. Making API calls from a browser is not recommended because it can expose your API keys.

Recommended Solutions

- Use a Backend Server

- Proxy API calls through a backend server.

- Securely handle API keys and requests with libraries like axios (Node.js) or requests (Python).

- Serverless Functions

- Use platforms like AWS Lambda, Vercel Functions, or Netlify Functions to handle requests securely.

- Full-Stack Framework

- Implement backend logic in frameworks like Next.js or Remix to manage API calls.

Why does my 0x transaction revert?

If your 0x quote is reverting, besides the standard revert issues related to ETH transactions, we recommend check the following are set correctly:

- Are allowances properly set for the user to trade the

sellToken? - Does the user have enough

sellTokenbalance to execute the swap? - Do users have enough to pay the gas?

- The slippage tolerance may be too low if the liquidity is very shallow for the token the user is trying to swap. Read here for how to handle this.

- Did the RFQ Quote expire? RFQ quotes from Market Makers are only valid for a short period of time, for example roughly 60s on mainnet. See "Did my order revert because the RFQ quote expired?" below for more details.

- Working in testnet? Only a subset of DEX sources are available. Be aware that token you want to use for testing must have liquidity on at least one of these sources; otherwise, you will receive an error. Read here for how to handle this.

For more details on addressing common issues, read Troubleshooting.

Did my order revert because the RFQ quote expired?

RFQ quotes from Market Makers are only valid for a short period of time, for example roughly 60s on mainnet.

Two ways to check if this was the reason for your order reverting, you can use the Tenderly debugger on the transaction, search for order info by looking at the getOTCOrderInfo step in the trace look for the expiryAndNonce field. You may need to reach out to 0x support to help you decode the expiryAndNonce field.

Therefore, as a best practice we highly recommend adding an in-app mechanism that refreshes the quotes, approximately every 30s, to make sure RFQ orders don’t expire. See Matcha.xyz for an example of this in action.

0x orders are reverting but my transaction is fine, what is happening?

Developers may note when analyzing their transactions that some subset of 0x orders may revert (not filled) but the whole transaction is successful. This is expected behavior as implied earlier, some orders due to timing, and the pricing may be filled or expired before a users attempt to fill the order. This would result in a revert and 0x protocol will utilize fallback orders to compensate for the reverted order. This will result in a successful transaction even though reverts occur within the transactions.

How does including taker, the address which holds the sellToken, in the API call help with catching issues?

By passing a taker parameter, 0x API can provide a more bespoke quote and help catch revert issues:

- 0x API will estimate the gas cost for

takerto execute the provided quote. - If successfully called, the

gasparameter in the quote will be an accurate amount of gas needed to execute the swap. - If unsuccessful for revert reasons suggested above, then 0x API will throw a gas cost estimation error, alluding to an issue with the

takerexecuting the quote.

TLDR Pass taker to get the quote validated before provided to you, assuring that a number of revert cases will not occur.

I received an INPUT_INVALID error. Help!

Check that the API request was formatted properly. If the issue persists, contact support to resolve the issue.

I received an BUY_TOKEN_NOT_AUTHORIZED_FOR_TRADE or SELL_TOKEN_NOT_AUTHORIZED_FOR_TRADE error. Help!

The buy token is not authorized for trade due to legal restrictions

I received an INTERNAL_SERVER_ERROR error. Help!

An internal server error occurred.

Check that the API request was formatted properly. Check 0x system status.

If the issue persists, contact support to resolve the issue.

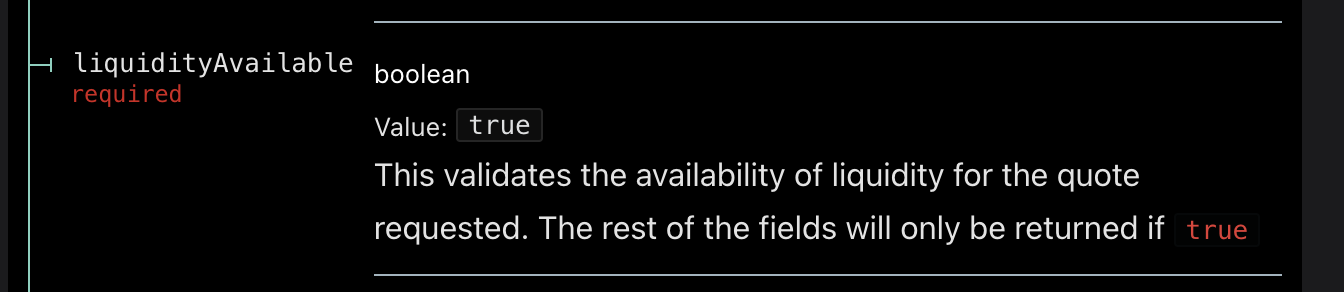

How will I know if the trade is not possible due to insufficient asset liquidity?

The API will return liquidityAvailable=false and not return any of the other response params if there is not enough liquidity avilable for the quote requested.

What does MEV protection mean?

Use the getSources endpoint.

Swap API

About Swap API

How do I get a list of all the sources the API is sourcing from?

Use the getSources endpoint.

How do I find a list of support chains for Swap?

Use the getChains endpoint to get a list of supported chains for Swap.

Is there a fee to use Swap API?

We offer two transparent, flexible tiers for Web3 businesses of all sizes. You can get started with them [here])(https://0x.org/pricing). If you are a high-volume app or have a unique business model, please contact us to discuss a custom plan.

0x takes an on-chain fee on swaps for select tokens for teams on the Standard tier. This fee is charged on-chain to the users of your app during the transaction. If you are on a custom tier, we can discuss customized options. In cases where we charge a fee, we'll return the value of the fee in the API response in the zeroExFee parameter. You can find more details about this parameter in the Swap API reference.

How does Swap API select the best orders for me?

Beyond simply sampling each liquidity source for their respective prices, Swap API adjusts for the gas consumption of each liquidity source with the specified gas price (if none is provided Swap API will use ethGasStation's fast amount of gwei) and any associated fees with the specific liquidity source. By sampling through varying compositions of liquidity sources, Swap API selects the best set of orders to give you the best price. Swap API also creates another set of fallback orders to ensure that the quote can be executed by users.

Ex: Swap API will adjust the price potentially received from Curve Finance by gas * gasPrice and its fees. Because of Curve Finance’s costly gas consumption, its nominal price may not be the best price when settled.

How can I find the tokens that 0x supports for trading?

0x supports all tokens by default except for tokens blocked for compliance reasons.

Is it possible to use the Swap API to trade custom ERC20 tokens or altcoins?

If you would like to trade a custom token, you will need to create the liquidity either by creating a Liquidity Pool for your token on one of the various AMM sources that the API sources from, such as Uniswap, SushiSwap, or Curve.

What does MEV protection mean?

MEV protection applies to RFQ (Request-for-Quote) orders, where quotes are filled privately and atomically to prevent sandwiching or front-running. It does not apply to AMM (Automated Market Maker) trades, which are executed on public mempools and are subject to typical MEV risks.

Monetizing your Swap Integration

I am building a DEX app using Swap API. Can I charge my users a trading fee/commission when using the Swap API?

You have the option to either collect affiliate fees or collect trade surplus. Read our full guide on monetizing your swap integration.

How is the trading fee/commission I charge returned by Swap API - is it part of the quoted price or is it a separate parameter?

If the swapFeeRecipient, swapFeeBps, and swapFeeToken parameters are set when making a Swap API request, the returned response will return a fees.integratorFee object with the amount property that can be displayed to your end user.

The amount is calculated from (swapFeeBps/10000) * sellAmount (in the sellToken base unit).

For example, to take a 1% fee on selling 100 USDC,

sellToken=0xA0b86991c6218b36c1d19D4a2e9Eb0cE3606eB48(USDC)swapFeeToken=0xA0b86991c6218b36c1d19D4a2e9Eb0cE3606eB48sellAmount=100000000(USDC has a base unit of 6 decimals)swapFeeBps=100(1% fee)

The fee amount would be 1000000, which is 1 USDC.

// Example quote response with fee.integratorFee object

...

"fees": {

"integratorFee": {

"amount": "1000",

"token": "0x833589fcd6edb6e08f4c7c32d4f71b54bda02913",

"type": "volume"

},

...

For examples and details, read our full guide on monetizing your swap integration. In API V2, you can charge opt to take your fee on either the buyToken or the sellToken in order to aggregate your revenue in a few tokens.

Can I collect trade surplus (a.k.a. positive slippage)?

Collecting trade surplus is only available to select integrators on a custom pricing plan. For assistance with setting up a custom plan, please contact support.

Read our full guide on monetizing your swap integration.

AllowanceHolder and Permit2

What is the difference between using AllowanceHolder and Permit2 for Swap API?

The 0x Swap API supports two allowance methods: AllowanceHolder (recommended) and Permit2 (advanced use only)

The main differences come down to UX, gas costs, integration complexity, and integration type.

When to Use AllowanceHolder (Recommended)

AllowanceHolder is the default and recommended allowance contract for most integrators. It provides a better UX, lower gas costs, and is designed to minimize common integration pitfalls that can occur with using Permit2.

Why use AllowanceHolder?

- ✅ Gas efficiency: Lower approval and execution costs than Permit2.

- ✅ Safer defaults: Reduces the chance of errors during integration.

- ✅ Simple UX: Works with standard approval flows without requiring double signatures, unlike Permit2.

- ✅ Equal Safety: Security guarantees are equivalent to Permit2.

AllowanceHolder is recommended for most integrators, and it is especially well-suited for:

- Teams aggregating multiple liquidity sources and aiming for a consistent user experience across wallets.

- Developers upgrading from Swap v1 (similar integration flow).

- Integration with advanced wallets (multisigs, smart contract wallets)

Endpoints:

Key Points:

- The correct allowance target will be returned in

issues.allowance.spenderorallowanceTarget. - More flexible than the traditional contract-wide approvals.

- Contract addresses are chain-specific, and can be hardcoded. Always verify with the official documentation before hardcoding:

0x0000000000001fF3684f28c67538d4D072C22734- Cancun hardfork chains (Ethereum Mainnet, Arbitrum, Avalanche, Base, Berachain, Blast, BSC, Ink, Linea, Mode, Monad, Optimism, Plasma, Polygon, Scroll, Sonic, Unichain, World Chain)0x0000000000005E88410CcDFaDe4a5EfaE4b49562- Shanghai hardfork chains (Mantle)

Further Reading: AllowanceHolder Contract

When to Use Permit2 (Advanced Integrators Only)

Permit2, developed by Uniswap, enables gas-efficient, flexible approvals with features like time-limited and granular allowances. It can be powerful, but it introduces risks that new integrators must be careful with.

⚠️ Permit2 is for advanced integrators only.

If you use Permit2, ONLY set allowances on Permit2. NEVER set an allowance on the Settler contract. Setting an allowance on Settler WILL result in loss of funds.

When to use Permit2:

- Your app requires time-limited or granular approvals that AllowanceHolder does not support.

- Your users already have infinite allowances set on Permit2 via another app — no reset is needed.

Endpoints:

Key Points:

- The correct allowance target will be returned in

issues.allowance.spenderorallowanceTarget. - Requires a double-signature flow. This is more complex to integrate but allows for features like time-limited approvals.

- Permit2 is deployed to

0x000000000022D473030F116dDEE9F6B43aC78BA3across all chains. You can hardcode this address in your integration.

Further Reading: Permit2 Contract

Should I use AllowanceHolder or Permit2 for my meta-aggregator project?

The decision when choosing between AllowanceHolder or Permit2 boils down to mainly UX and integration type.

AllowanceHolder is ideal for single-signature use cases and provides a consistent user experience when aggregating across multiple sources. It also closely resembles the 0x Swap v1 integration, making it quicker to implement.

Permit2 is a universal standard that allows users to share token approvals across smart contracts (i.e. if users have an infinite allowance via another app, no reset is needed). However, Permit2 requires an additional signature (a signature for limited approval and a signature for the trade itself), which may impact user experience.

Evaluate your project’s needs and the desired user experience to make the best decision.

If an allowance is needed when using AllowanceHolder, which contract will issues.allowance.spender or allowanceTarget return?

The AllowanceHolder contract will be returned.

How should the signed the Permit2 EIP-712 (permit2.eip712) message look?

The standard encoding of a signature in Ethereum decomposes the secp256k1 signature into 3 values: r, s, and v.

Typically these are ordered as v, r, s, but Permit2 requires that they be ordered as r, s, and v, where

ris less thansecp256k1nsis less thansecp256k1n / 2 + 1, andvis either0or1to indicate the sign (or equivalently the parity) of theycoordinate. However, the convention on the EVM is thatvis actually encoded as27 + v(i.e. either 27 or 28). Make sure your signature adds 27 tov

Then, all 3 values are packed and encoded as 65 bytes (bytes 0 through 31 represent r, 32 through 63 represent s, and byte 64 represents v).

Parameter Questions

What is gas?

Gas refers to the fee required to successfully conduct a transaction on the Ethereum blockchain. Gas fees are paid in Ether (ETH) and denominated in Gwei, which is a denomination of Ether (1 ETH = 1,000,000,000 Gwei).

What is the significance of this address 0xEeeeeEeeeEeEeeEeEeEeeEEEeeeeEeeeeeeeEEeE ?

The address 0xEeeeeEeeeEeEeeEeEeEeeEEEeeeeEeeeeeeeEEeE is a standardized representation of native tokens in blockchain transactions. Native tokens, such as ETH on Ethereum, BNB on Binance Smart Chain, and POL on Polygon, are the foundational currencies of their respective blockchains. Since native tokens do not inherently have an address (unlike ERC-20 tokens), this address is widely used by dapps to facilitate interactions with native tokens in a standardized way.

- On Ethereum: This address represents Ether (ETH), as ETH is not an ERC-20 token.

- On Mantle Network: An exception is the native token $MNT, which does have a contract address (

0xdeaddeaddeaddeaddeaddeaddeaddeaddead0000) for use on the Mantle EVM chain. This address is specific to $MNT on Mantle and does not apply to wrapped or bridged versions of $MNT on other networks. See this guide to understand other differences between Ethereum and Mantle.

For more details:

Additionally, refer to the Handling native tokens with 0x Swap API guide, which explains how to manage native tokens when using the 0x Swap API, as their handling differs from that of standard ERC-20 tokens.

Does the 0x API return buyAmount in the base unit of the given token?

Yes. All buyAmounts returned by the 0x API are returned in the base unit of the token.

For example:

- For an ERC20 token with 18 decimals (like WETH or DAI),

buyAmount: 1000000000000000000represents 1.0 token. - For a token with 6 decimals (like USDC),

buyAmount: 1000000represents 1.0 token.

You’ll need to account for token decimals in your frontend or application logic if you want to display human-readable values.

Need help handling decimals? You can use utility libraries like:

Is it possible to quote by the buyAmount?

No, only quoting by sellAmount is supported.

The buyAmount parameter has been deprecated starting in v2 in favor of purely sellAmount for more deterministic and user-friendly behavior. Using sellAmount ensures any unused tokens are refunded, while buyAmount can result in over-purchasing due to slippage and inconsistencies across liquidity sources. Additionally, some sources (e.g., Kyber) do not support quoting by buyAmount, reducing available liquidity. By transitioning to sellAmount, we align with industry trends and offer more predictable execution for users.

Can I skip validation for the /quote endpoint by leaving the takerparameter blank?

No, the taker parameter is required in v2 for /quote. It enables us to return calldata and any issues that may have caused a failure during quote validation.

Why does the value of the to field in the /swap/quote response vary?

The to field value varies based on the current Settler contract address. The Settler contract is designed to be redeployed, resulting in different target addresses. See here for how to find the latest Settler address list of current and future 0x Settler addresses.

Best Practices

What is the best way to query swap prices for many asset pairs without exceeding the rate limit?

Contact 0x to discuss a solution that best suits your use case.

How can I display the 0x Swap Fee to my end users?

The 0x fee amount is returned in the zeroExFee parameter in the quotes where we charge the fee. You are responsible for ensuring your end users are aware of such fees, and may return the amount and token to your end users in your app. Read more about the zeroExFee parameter in the `/quote response.

The applicable fee for each plan is detailed in our Pricing Page.

Is there a way to sell assets via Swap API if the exact sellToken amount is not known before the transaction is executed?

Not currently, but we are exploring this feature.

How can I get the ABI for an ERC-20 contract via TypeScript?

- Do it "manually" by getting it from the appropriate chain scanner. For example on Etherscan > enter the contract address > click on the Contract in the tab section heading > Scroll down to find the Contract ABI > click on the Copy icon to copy it

- If the source code has been published to Etherscan, use the API to retrieve it: https://docs.etherscan.io/api-endpoints/contracts

- If the token has the abi in their github repo, programatically access it from the github repo

- Import the

erc20Abiconstant from viem: https://wagmi.sh/core/guides/migrate-from-v1-to-v2#removed-abi-exports

What’s the best way to access 0x trade data?

It depends on your use case — whether you're analyzing past trades or tracking them in real time.

We recommend checking out our 0x transaction data guide, which walks through two main approaches:

- 0x Trade Analytics API — Ideal for historical analysis, usage tracking, and reporting. Query trade data tied to your API key or filter by parameters like token, protocol, or time range.

- 0x-parser — A TypeScript library for decoding and interpreting real-time 0x transaction data from onchain logs. Great for custom dashboards, bots, or alerting systems.

Whether you're building internal analytics or parsing live activity onchain, this guide will help you choose the right tool for the job.

Can I detect whether a transaction originated from the 0x API by parsing transaction receipts?

It's a common question — and the short answer is: not directly via onchain data alone.

While all 0x API trades are settled through the 0x Settler smart contract, these transactions don’t include a unique tag or flag that explicitly ties them to the API.

That said, there are a few ways to approach attribution, depending on what you're trying to track:

🔍 If you're trying to track your own app's activity

- The 0x Trade Analytics API is the best place to start. It allows you to query detailed trade data associated with your API key.

- Enable onchain tagging. In your 0x Dashboard, go to your app’s Settings and toggle on “Enable onchain tagging.” This makes it easier to filter and trace your transactions onchain later.

🌍 If you're trying to detect any and all transactions routed via the 0x API

- You can monitor the 0x Settler contract for activity, but this includes all transactions — not just those initiated via the 0x API.

- Currently, there is no canonical event that maps directly to “this came from the Swap API,” but we’re exploring ways to make API attribution more accessible in the future.

- If you're interested in aggregated Swap API usage data, we may be able to share insights or internal tools depending on your use case. Reach out to us — we’d love to hear more about what you're trying to build.

We understand attribution is an important use case, whether you're tracking your own usage or seeking broader ecosystem insights. Don’t hesitate to contact us to discuss how we can best support you.

Gasless API

Trade Analytics API

See here for Trade Analytics API FAQ

0x Dashboard

Does the 0x Dashboard support having multiple user accounts for our team?

For now we only support one user per team account, but we will add support for multiple users in the coming weeks.

What is an App?

An app is a self-contained unit for each individual application that you’re building. You can set up multiple apps, each with its unique API keys and configurations on the 0x Dashboard.

Smart Contracts

Are the smart contracts audited?

Yes, see details of the audits. Checkout our bounty program.

Building with 0x

My project would like to integrate 0x. How can I contact the 0x team?

We appreciate your interest in building with our APIs. To get an API key and start building for free, please create an account on the 0x Dashboard. You may also check out all our available plans and contact our team for more custom needs. Our team will review and respond to you.

My project is interested to apply as a liquidity source in 0x ecosystem. How can I contact the 0x team?

Thank you for your interest in providing liquidity to the 0x ecosystem. Please fill out the relevant form below for our team to review and reach out to you.

- If you are looking provide AMM Liquidity

- If you are looking to provide RFQ Liquidity