How Coinbase brought onchain markets into their exchange app

"Working with 0x allowed us to integrate decentralized markets directly into multiple Coinbase products."

$107M$91M

Onchain Volume16M14M

Tokens supported

Unified experience

The best of both worlds

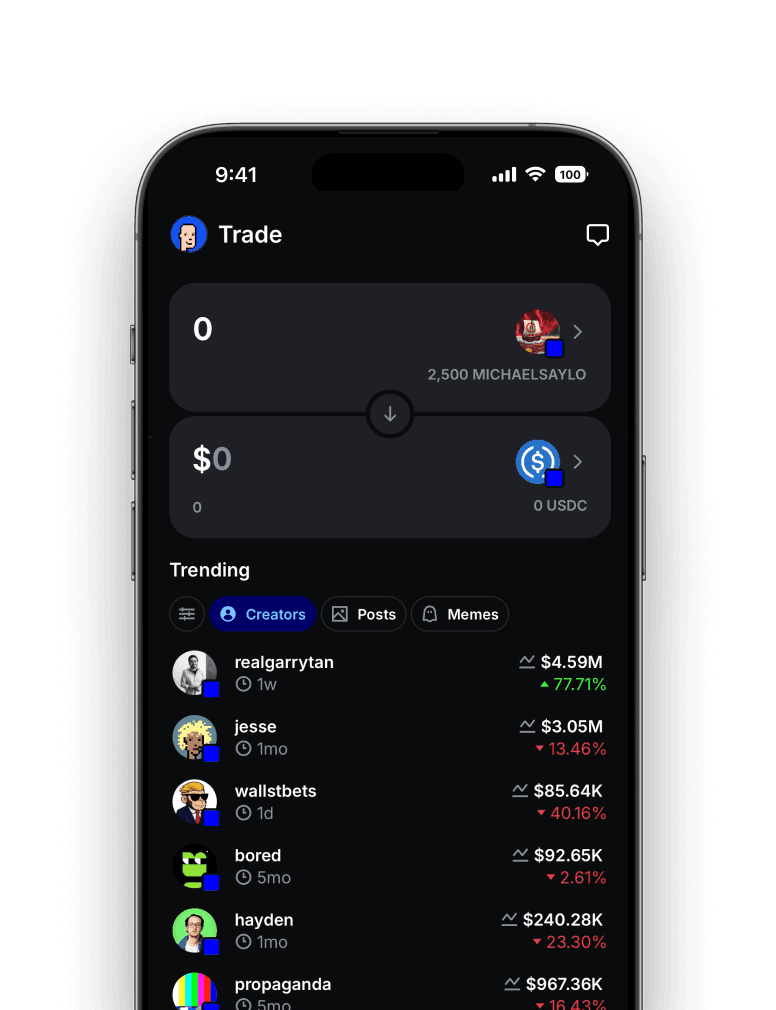

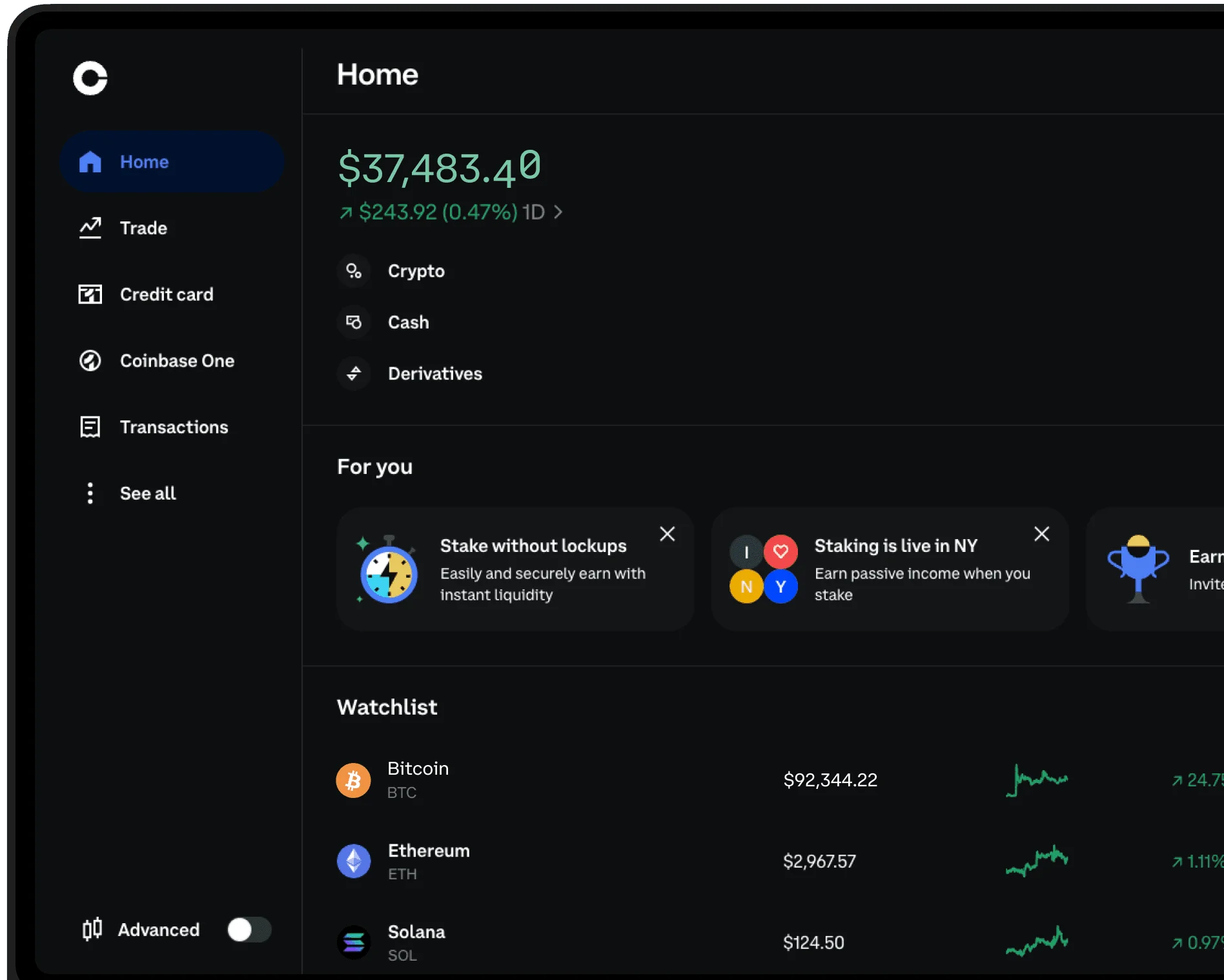

Coinbase uses 0x to power DEX trading directly inside the main Coinbase Exchange App, giving users access to millions of tokens and deep onchain liquidity, while preserving a familiar, professional trading experience.

0x delivers fast, comprehensive coverage of onchain markets from within your existing app, with enterprise‑grade execution and reliability.

The challenge

Crypto scaled from a few tokens to millions of onchain assets, with thousands more launching daily

1000s+

Tokens launched daily

Liquidity is fragmented across hundreds of DEXs, and traders want instant access to new tokens.

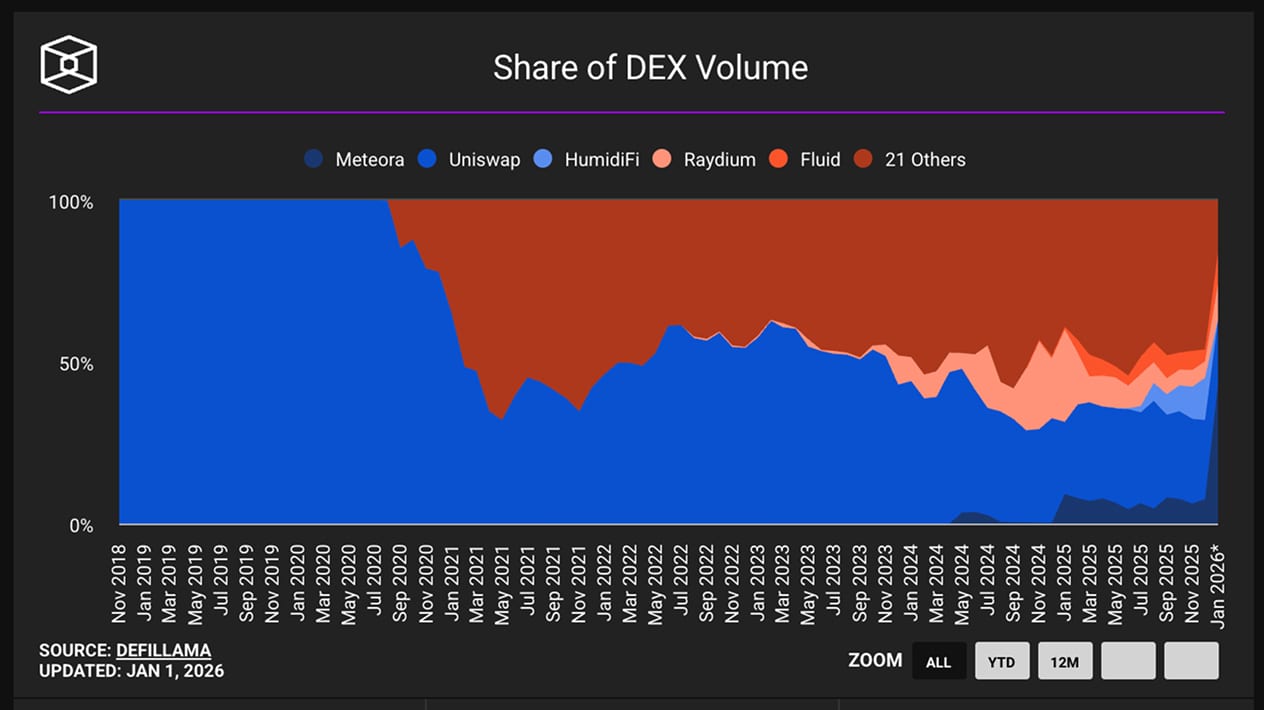

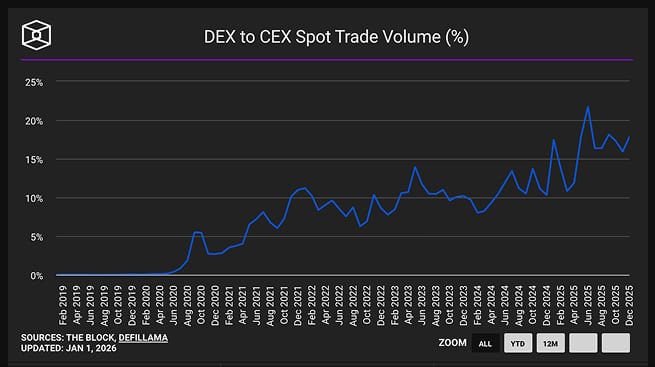

DEX volumes grew from $666 million in January 2020 to $500 billion today, an opportunity too big to ignore.

CEX listing processes can't keep up, which could mean missing out on billions of trading revenue. By the time tokens have been approved for trading, they are often already irrelevant.

Trading is moving from CEXs to DEXs, and DEX volume has doubled since 2024. To stay relevant, Coinbase needed a way to:

- Match onchain token coverage and instant trading

- Prevent users and volume from churning

- Reduce onchain risk with built-in safeguards

0x delivered a solution that allowed Coinbase to manage all three, launching Coinbase DEX trading's first onchain assets in August 2025.

Token Coverage

Coverage for millions of tokens across dozens of chains

Coinbase already used 0x to power DEX swaps in the Base App. The next step was to bring that same coverage and routing into the main Coinbase Exchange App so users could trade any token without moving funds off-platform.

Broader coverage, instant access

DEX trading through 0x lets Coinbase surface millions of tokens within moments of being indexed onchain, without needing a traditional listing process for every asset

One unified experience

Powered by 0x, Coinbase is a gateway to onchain markets. Users can:

- Fund trades with their Coinbase balance

- Swap tokens in a familiar, trusted UI

- Track their portfolios in one place

Transparent and safe trading

Trading long-tail tokens opens risk vectors. Coinbase pairs 0x routing with onchain data for:

- Liquidity and pricing insights

- Slippage and volatility indicators

- Risk signals for suspicious or illiquid tokens

More networks, assets and markets

With 0x, Coinbase can:

- Add new EVM chains and L1s with little coding

- Expand DEX trading to more countries

- Stay relevant as liquidity shifts across networks, assets, and platforms

Best execution

Coinbase is known for a professional trading experience

To retain and attract users, it needs reliable, high-quality DEX execution for millions of tokens. Trade execution in DeFi demands a sophisticated backend that can:

- Inspect onchain liquidity for slippage and price impact

- Control execution costs such as gas fees

- Bundle it into a process that is reliable and fast

For Coinbase, solving onchain execution at scale required 0x's routing and aggregation expertise.

Explore your use case

Our suite of APIs has processed over 211 million transactions and $180 billion in volume from more than 14 million users.

Contact salesHow 0x solves onchain execution:

0x delivers transparent quotes that bundle gas costs, protocol fees, and price impact into a single number. No hidden fees, and trade execution your users can trust.

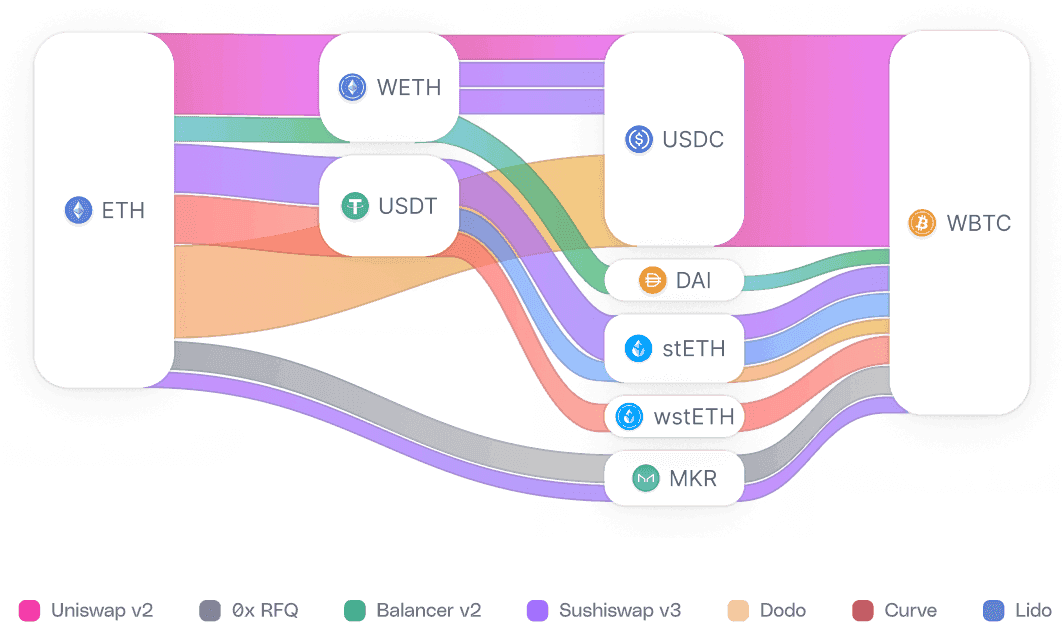

0x taps into 373 liquidity sources across every major DEX and AMM. By aggregating fragmented liquidity pools, trades execute at better prices with less slippage than any single venue.

The 0x routing engine intelligently splits orders across multiple paths and liquidity sources. This multi-hop routing finds optimal paths through intermediate tokens to minimize price impact on large trades.

Enterprise-grade infrastructure delivers sub-250ms response times. Fast quote generation means prices stay accurate, and rapid execution ensures users get the rates they expect.

Partnership

Coinbase's drive to deliver best-in-class swaps with the widest token coverage led them to 0x

Coinbase has relied on 0x's battle tested trading API infrastructure since 2021. Our secure contracts, proven track record, responsive team, and market-leading execution are why Coinbase chose 0x to power DEX trading inside the Coinbase Exchange app.

The results

Limited list of curated tokens

0x Swap API

Millions of onchain tokens

+24%+20%

Trading volume in Q4 2025112k95k

Users trading on Coinbase DEX$107M$91M

Onchain trading volume99.91%84.92%

Uptime<239ms

Best observed response timeWith DEX trading embedded in the Coinbase app:

- Traders can access new assets in minutes after launch

- Users stay in the app longer and are less likely to churn

- Token issuers can reach distribution without waiting for a listing

By choosing 0x, Coinbase expanded from 300 listed assets to millions of tokens via a single integration, helping move closer to its vision of becoming the "everything app" for crypto.

Take your exchange to the next level

With 0x, you can take the next steps your users are waiting for. We can help you to:

- Offer instant onchain token access in your own branded app

- Retain users who would otherwise trade on third-party DEXs

- Maintain reliability and control while benefiting from DEX liquidity